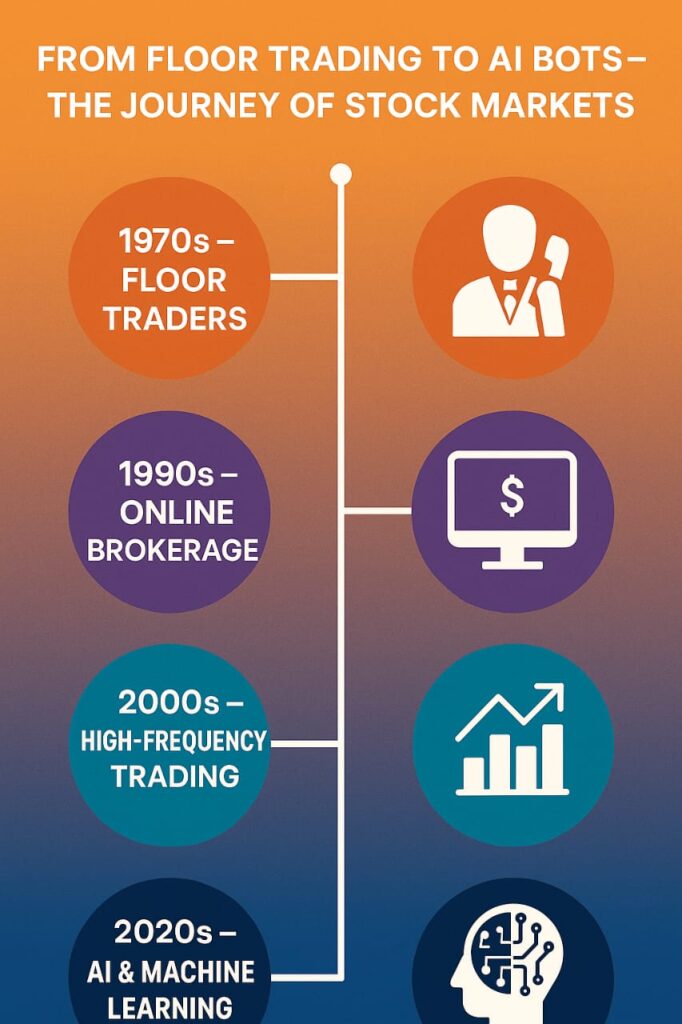

AI stock trading has changed the whole landscape of trading , it has changed the whole concept of trading far beyond shouting on trading floors and placing orders through brokers. With the rise of Artificial Intelligence (AI) new methods of trading have been introduced . These methods are fast , accurate and more capable of decision making powers. AI stock trading is useless ?

In this article we will dive deep into AI stock trading vs Traditional stock trading and weigh the pros and cons of each .

What is Traditional Sock Trading ?

AI Stock Trading VS Traditional Stock Trading

What is AI Stock Trading ?

AI stock trading is different type of trading then traditional stock trading because it uses algorithms, machine learning and pst data to automate trading decisions . These type of AI models dedicated for AI stock trading analyze market patterns , predict trends and execute trades within milliseconds .

Examples :

There are many examples of AI stock trading like

Robo-advisers like Betterment and wealthfront

Hedge funds that use algorithmic trading platforms

Ai tools that are used it on platforms like MetaTrader or NinjaTrader

What is Traditional Stock Trading ?

The main trait of traditional stock trading is that it involves human decision making through individual investors or financial advisors . Traders analyze news , charts and financial statements , market trends etc. to make best informed decisions .

Examples :

Professional traders that are trained to work on stock exchanges

Brokers who has given the task to execute trades on behalf of clients

Individual investors using brokerage apps

AI Stock Trading VS Traditional Stock Trading

Pros and Cons Comparison

| Feature | AI Stock Trading | Traditional Stock Trading |

| Speed | Executes Trades in milliseconds | slow due to manual decision making |

| Data Analysis | It can analyze massive data in real time | Human capacity and time constraints |

| Emotion Free decisions | No emotional Bias | Subject to human emotions |

| Learning and Adaptation | Designed to learn from historical data and improve over time | Depends on experience and judgement |

| Accessibility | Technical setup , softwares/platform etc are needed | More accessible for beginners |

| Transparency | Algorithmes can be hard to interpret | Human decisions can be explained based on logic and reasoning |

| Regulatory Oversight | Less regulations in more regions | well established regulatory systems |

| Cost | Initial cost requires investment in tech and tools | Initial cost is lower upfront |

| Market Reaction | Volatile . Can do overreactions to micro signals | More calculated and cautious |

Pros of AI Stock Trading

1.Speed and Efficiency

The best trait of AI stock trading is that it is designed in a way where AI systems can process and react to information in real time . AI stock trading executes trades way faster than any human .

2. Data Analysis

AI is capable to analyze big data , including financial metrics , statements, social media sentiments and many more .

3. Emotion Free Decisions

AI is a machine that means it is incapable to reflect emotional bias . A it does not experience human emotions that is why it follows logic and programmed strategies .

4. Strategy Optimization

Past data can used to optimized the trading strategies specially before going live . That helps to reduce risks.

5. Round the clock monitoring

AI tools are capable to monitor markets across different time zones continuously round the clock 24/7.

Cons of AI Stock Trading

1.High Initial Cost

The initial set up cost of AI trading system could be very expensive .

2. Difficult to Understand

AI trading could be very difficult to understand , not everyone can get why an AI system made a particular trade . It’s complex algorithm does not ensure transparency.

3. Overfitting

The difference between testing and live conditions could be huge. Many AI stock trading model may perform really well in testing conditions but could fail in live conditions.

4. Vulnerability to Market Shocks

AI stock trading model could be very unstable . There are high chances that these model over react to market signals or not react well to sudden market crashes etc .

5. Regulatory Challenges

There are less regulations around AI stock trading . Rules around AI Stock trading are still evolving around the world .

Pros of Traditional Stock Tracking

1.Human Touch (Judgment and Intuition)

Human traders can leverage on the human qualities to assess the non quantifiable factors like political developments , cultural changes or Company environment etc .

2. Flexibility

Humans does not run on algorithms, that is why they are capable to adjust strategies based on new information and their gut feelings etc.

3. Learning Experience

There is a huge learning opportunity in traditional stock tracking as compare to AI stock trading . Beginners can take their time to grow through trading .

4. Transparency

There is a huge transparency in Traditional stock trading as the traders can explain their decisions and the logic behind taking those decisions .

Cons of Traditional Stock Trading

1. Emotionally Driven Decisions

The common emotions like fear, anxiety , stress, anger etc can lead to poor decision making.

2. Slower Execution

All trades in traditional stock trading are done manually that is why there can be many delays

3. Time Intensive

Traditional stock trading is very demanding , it requires constant research , monitoring and analysis

4. Limited Data Handling

Humans have limited capacity to handle massive data.

Conclusion

AI stock trading offers fast data processing capabilities , that makes it perfect for short term and high volume trading . It represents the future of finance . It’s unmatched speed and analytical capabilities has made it stand out . Despite being fast and efficient with the ability to process massive data it has it’s own limitations . Like it can not replace the human intuition and strategic thinking of experienced traders . It does not matter if you are leaning towards AI stock trading or the Traditional Stock trading , understanding both approaches can be beneficial because they can help you make smarter and more accurate and informed investment decisions .

Learn More about AI Stock Trading : AI Trading Bots: A Beginner’s Guide

AI In Financial Services: Transforming Stock Trading

The Disruption Of AI In Stock Markets: A New Era Of Investment Decisions And Automation