In the age of digital transformation ,artificial intelligence has revolutionized every industry including personal finance . Budgeting , which is one of the most important part of personal finance was once a mundane and manual task that involve spreadsheets and notebooks . Now AI financial tools has made it smarter , faster and more intuitive .

In this article we will dive deep into how AI is transforming budgeting and the best AI financial tools available for smart budgeting .

What’s wrong with Traditional Budgeting ?

Risks and Challenges of AI Budgeting Apps

What’s wrong with Traditional Budgeting ?

You might think why budgeting mattes ?, well budgeting is essential for managing expenses , reducing debt , managing risks and achieving financial goals . Statistically 63% Americans reported to live paycheck to paycheck in 2023 according to a report by LendingClub and PYMNTS. That shows not many people can afford to spend money mindlessly , they need smart investment strategies , practical saving goals and good budgeting ideas to become financially successful . Traditional Budgeting tools like spreadsheets or generic apps lack customization etc , in short they don’t provide many options to get predictive insights about your finances .

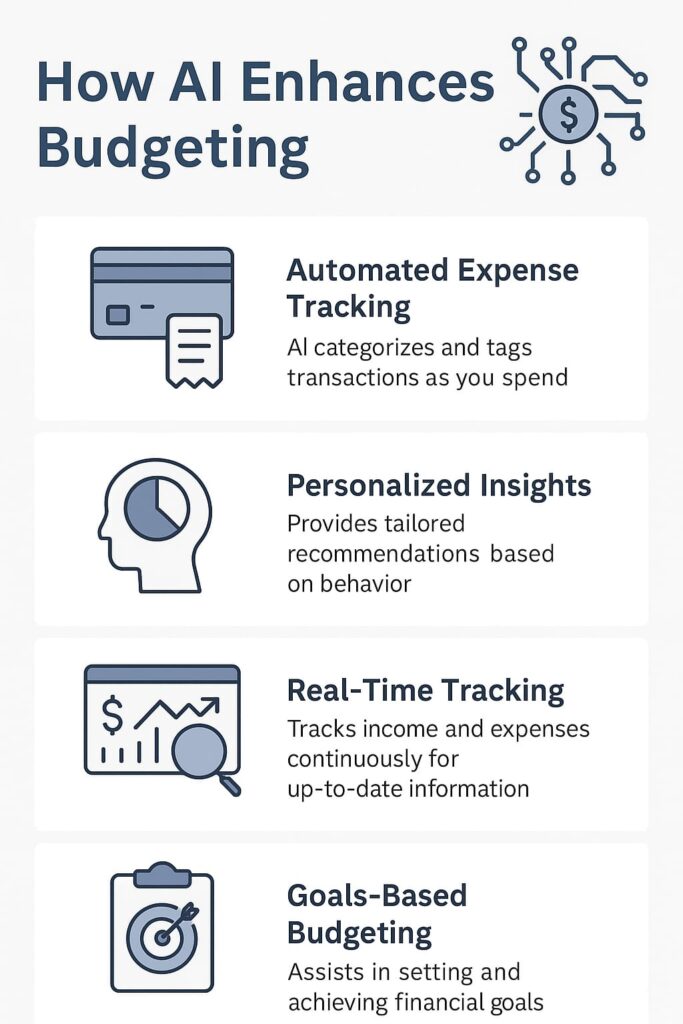

Budgeting with AI financial tools helps to track irregular spending , setting realistic financial goals , make adjustment to income changes . lets discover more how Ai enhances budgeting .

How AI Enhances Budgeting

AI financial tools provide smart apps to mange budgets . They apps are build on machine learning and predictive analytics to automate and personalize financial planning . Here is how budgeting as AI financial tools are helpful .

Automated Expense Tracking

The best feature of smart budgeting apps as AI financial tools is that it can categorizes transactions in real time by connecting to your bank accounts and credit cards . There are many smart AI budgeting Apps like Copilot , Truebill and Cleo that automatically detect recurring payments , flag irregular spending and track changes over time .

Personalized Budget Recommendations

AI financial budget tools are designed in a way that they provide dynamic budget suggestions based on spending habits . AI tools like YNAB (You need a budget) adapts monthly plans based on your monthly income . There are many other AI tools that can be used to align budget with long term goals like buying home or paying off student debts etc like Monarch Money etc

Predictive Analytics

AI can forecast future spending based on your past habits of spending patterns . There are many apps like Mint and Plum alerts users before they overspend or suggest how much to save . Such apps are like AI financial tools that can be utilized as financial advisers .

Best AI Budgeting Tools

YNAB : It features zero based budgeting goal tracking

Cleo : It features chat based interface and spending analysis

Copilot : It tracks expenses and cash flow management .

Monarch Money : It features net worth tracking , family sharing

Rocket Money : It features Bill negotiation , subscription detection .

Real Life Use Cases :

AI Budgeting In Action

Subscription Management .

In 2022 C+R research published a report stating that 42% of consumers forgot they were still paying for at least one subscription . Not everyone can remember to cancel their monthly subscriptions . That’s why AI budgeting apps like Rocket Money and Truebill automatically scan bank accounts to identify and cancel automated subscriptions .

- Financial Coaching

AI budgeting tools can be your next financial advisers . AI Financial apps like Cleo can use artificial intelligence to analyze transactions and deliver budgeting advice in a conversational way . Because of its fun and user friendly design, Cleo is one the best apps to increase financial literacy among young users .

- Debt Payoff Strategy

One of best use of AI financial tools to make strategies to get rid of your debts . There are many apps available for android and apple users like Tally and YNAB that use AI to develop payoff strategies . For example : Tally is the app that use algorithm to determine the most efficient way to pay off credit card debt.

- Emergency Fund Forecasting

AI financial tools can take care your finances in future . They can predict future expenses and suggest practical and effective savings goals . For example AI budget app Monarch Money allows users to stimulate different financial scenarios like health emergencies , unemployment etc. to help you automatically adjust the budget accordingly . In this way you are already preparing for every worst case scenario ever .

Risks and Challenges of AI Budgeting Apps

While it is a fact that AI budgeting apps are very helpful but they have their own drawbacks too .

- Privacy Concerns

The first drawback of AI budgeting apps is relevant to privacy concerns . All AI budgeting apps need access to your financial data to function . Even though they might not be able to withdraws cash etc because most bank use encryption etc but still these apps can sell you data . A 2023 survey by KPMG revealed that 53% of users worry about how their data is used by financial apps .

2. Over Reliance

Over use of AI budgeting apps can ruin your own budgeting skills because automation leads to disengagement . Following the AI budgeting tools can lead to lack of understanding of your own finances .

3.Algorithm Bias or Errors

AI budgeting apps work based on the algorithm . if the forecasting is based on flawed data then users may not get the accurate insights .

How to choose the right AI Budgeting Tool

It depends on what you looking for . Choosing the best AI financial tools depends on your own financial goals and your preference of technology (your level of tech savviness might play a big role in choosing a certain app)

In this article wer are breaking down a very quick checklist for you .

For beginners : Strat with easy to use app like Cleo or Rocket Money

For Long term financial Planning : Use Ai budgeting app specifically designed for this like Monarch Money

For Investing along with budgeting : Us YNAB (You Need A Budget) or Copilot

For chatbot interaction : Use Chatgpt with right prompts .

Conclusion

AI budgeting tools has revolutionized the finance world . These AI tools does not just automate budgeting , it transform it into more engaging and smart process. By reducing the mental load , these Ai budgeting apps provides a fast , smart and efficient insights and helping users organize their finances in the best way possible . It is a fact that AI budgeting apps has reshaped how individuals manage money .

What are the best AI financial tools for smart budgeting ?

There are many AI tools for smart budgeting for example YNAB (you need a budget) , Copilot, Mint, ChatGPT AND Cleo etc

Learn more AI and Fiance here